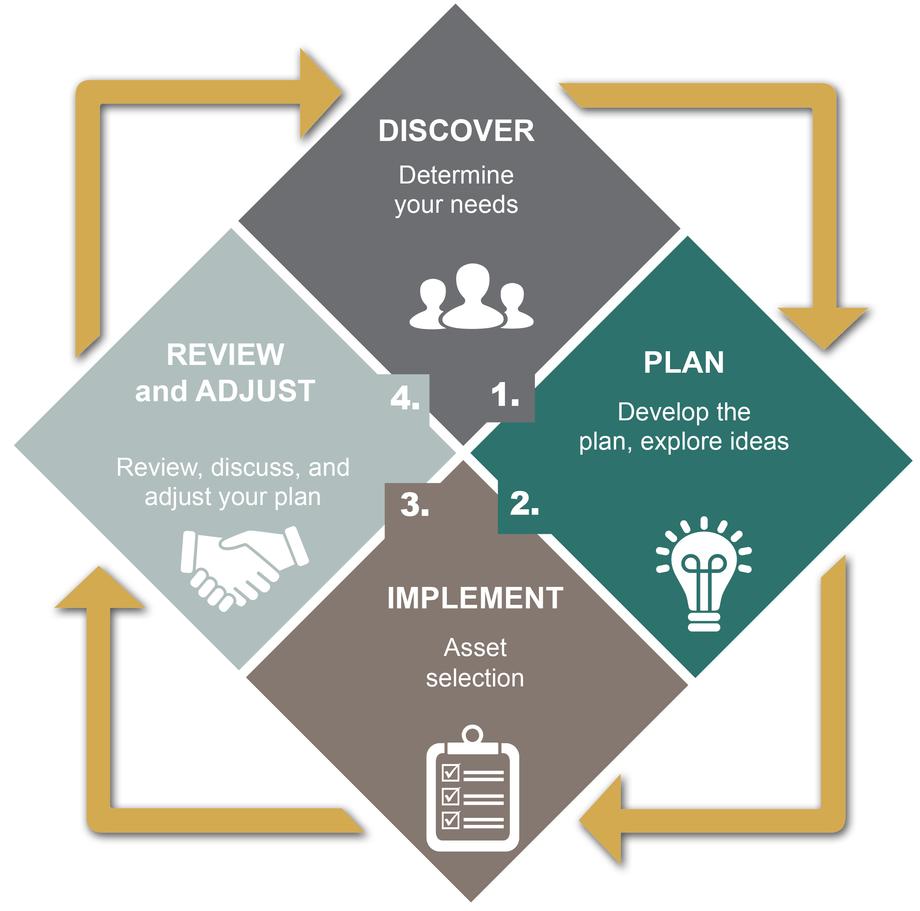

Investment Process

The basis for successful investing lies in understanding client goals, objectives, risk tolerance levels and return expectations. The financial planning process is the best method of determining those goals.

The basis for successful investing lies in understanding client goals, objectives, risk tolerance levels and return expectations. The financial planning process is the best method of determining those goals.

Step One: Discover

Determine your needs by reviewing your current assets, income, financial objectives, risk tolerance and goals for the future.

Step Two: Develop a plan

Create a customized plan based upon your goals and financial picture. Your plan may include investments and asset allocation for retirement planning, estate planning or education funding.

Step Three: Implement the plan

Implement your plan using a full array of prudent investment strategies.

Step Four: Review and Adjust

The planning process is characterized by reviewing and discussing your progress, exploring new ideas and adjusting your plan as needed.

Satisfaction comes from knowing you've made smart, thoughtful choices and from knowing you have a plan. Helping you with your plan, and helping you achieve satisfaction, is what we do.